Why is a venture studio the right co-founder?

I like analogies when explaining somehow complex subjects. I believe they help build early curiosity and interest towards content. Here is one.

In banking, expected loss (EL) is one of the most important indicators that defines risk appetite and influences decision towards credit applications. In simple terms, banks want to earn more money than their expected loss for every credit to make profit, because some of their debtors will not pay them back. To correctly calculate EL, there are three independent indicators that need to be studied separately:

- Probability of default: this is fairly straightforward – an indicator of likelihood that the debtor will fail to pay back

- Loss given default: in the event of default, due to collaterals or guarantees, banks can somehow get some part of their money back. This is the estimated percentage that they will not be able to get back

- Exposure at default: this is the amount of remaining principal that is still to be paid back in the event of default and it changes according to loan type

So, it can be said that banks try to identify rotten eggs within a basket full of eggs and build policies around the cases where there are different risk levels. But the goods news is that, usually there are not that many rotten eggs in the basket.

In entrepreneurship, this is just the opposite. Entrepreneurs try to identify the fresh eggs within a basket mostly full of rotten eggs. And very occasionally there are some golden eggs (unicorns?) among the fresh eggs.

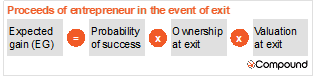

If we were to define an indicator for entrepreneurship with the similar objective of expected loss in banking, it would be expected gain (EG). This indicator can be considered as the proceeds of entrepreneur in the event of exit for simplicity. Let’s try to break this down to independent indicators:

- Probability of success: entrepreneurship is risky as well known. This is an indicator of likelihood that start-up will not fail and reach exit

- Ownership at exit: entrepreneurs most usually partner with other co-founders and to scale their businesses they get external investment. These two dilute the ownership percentage of a single entrepreneur greatly until exit. This is the percentage of owned company shares for a single entrepreneur in the event of exit

- Valuation at exit: this is fairly straightforward

Now let’s explore each one of them with comparing two cases. First, if an entrepreneur goes through traditional start-up steps and next if he/she partners with a venture studio.

Probability of success

As it is, being an entrepreneur is like buying lottery ticket. At global level, 90% of start-ups eventually fail. The reasons why they fail is a topic for another post. In Turkey, where our venture studio Compound primarily operates, this percentage is even slightly higher. This is not a discouragement, but rather stating the fact that there is about 10% success probability of a single venture in entrepreneurship. This probability can go up by some degree for seasoned entrepreneurs and can go down for first timers.

There are several studies about the success rate of companies created by venture studios. A study including 23 leading venture studios, which collectively established 415 companies, found that only 9% of those created have failed. The remaining companies have either successfully exited or are active with average ARR of over USD 1M. So according to this study, the success rate in single venture created by a venture studio can be argued to be about 90%. Let’s break this success down with more data from Global Start-up Studio Network (GSSN):

- 99% of ventures created by studios secure seed funding

- 72% of ventures created by studios secure series A funding

Success rate of venture studios obviously has variance. Younger venture studios can have slightly lower success rate in their initial batch of companies. As venture studios mature, increase in their success rate can be expected. Juxtapose, a successful venture studio in USA has 100% success rate in 30+ companies built. Their definition of success is reaching Series B or further within 3 years of company establishment, which is another success in terms of speed. Even with venture studio metrics, the probability of 100% success in 30+ ventures considering about 90% success rate in a single venture corresponds to about 4% compound probability. So, there should be some secret in all of this, right? This is how:

- Sourcing of idea: the partners of venture studios usually have hands-on experience in venture building and start-up ecosystem, so that they can internally or externally source and filter the better-fitting ideas to investment thesis of the studio

- Validation: venture studios rigorously execute their idea validation process. During this process studio spends money and effort obviously. This process is carried out sometimes with the future CXO of the company – founder-in-residence. There are usually several start-overs with other ideas until one turns into a company. Although validation process of each studio is different, they all aim to confirm there is sizeable and scalable business to seek after and there is early product–market fit for the concept. So, this process eliminates most of the risk with pursuing the wrong idea for the market.

- Ability to unplug during stealth mode: Sometimes, due to external factors and changes in validation settings, a validated idea may not generate necessary traction or indication to reach escape velocity with planned effort. Venture studios usually prefer to keep their projects in stealth mode until they are confident with their traction metrics. Occasionally they kill their projects during this stealth mode to ensure money and effort are spent optimally across portfolio.

All these factors effect numerator and denominator of success rate of venture studios and create significant difference.

An entrepreneur going through traditional start-up steps often pursues a single idea, puts little to no validation effort (mostly due to lack of know-how) and does not have the luxury to unplug the company at an early stage.

Additionally, venture studios have higher exit rate than alternatives. In a study covering venture studios, the exit rate of portfolio companies is over 30% (34% to be precise). This is almost twice of start-ups going through accelerator programs and multiple times higher than the general average.

Ownership at exit

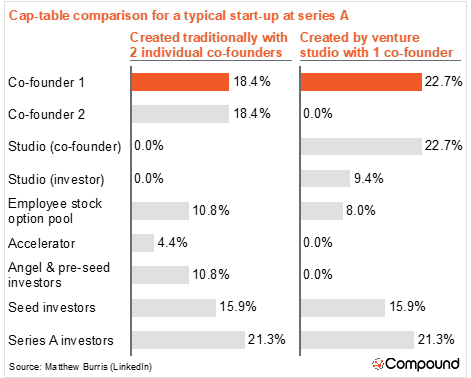

Venture studios are institutional co-founders with central team and capabilities across many areas. For example, at Compound, we provide extensive support and execute tasks together with co-founders in strategy, design, marketing, technology, finance, legal and HR areas. So, venture studios replace the need for at least 1 individual co-founder in a traditional start-up setting.

Also, venture studios eliminate the need to partner with an accelerator during early stages of the start-up and to give up some equity. The services that can be obtained from an accelerator are almost always available for free at venture studios.

Additionally, due to having central team and repeatable company-building playbook, start-ups created by venture studios have lower build costs requiring less early fundraising resulting with less dilution at the beginning of journey.

Finally, again due to availability of central studio team, some of early hirings can be postponed resulting with less need to build a large employee stock option pool.

Matthew Burris, a thought leader on venture studio model created a simulation of how cap table can progress in the case of building start-up traditionally with 2 co-founders and partnering with a venture studio as a solo founder. Here is a simplified version of it:

Of course, this is just a simulation and equity split between studio and individual co-founder can be very different for each studio and each circumstance such as being an early or late co-founder. But, it can be strongly argued that individual co-founders will be more incentivised when they partner with a venture studio compared to going traditionally and partnering with individual co-founders. The same math also works in a setup of 3 co-founders with venture studio again replacing 1 of individual co-founder.

Valuation at exit

Average unicorn rate is about 1.3% for all start-ups. This rate increases to around 5% for companies created by studios according to GSSN. It is at very similar levels to the portfolio of prestigious organisations like Y-combinator, which has unicorn rate of 5.4%. So, it is fair to argue that the companies built by venture studios will be larger compared to traditionally created ones.

Additionally, companies created by venture studios scale much faster compared to the ones created traditionally. Average company age at exit is 3.8 years for companies created by ventures studios, whereas it is 6.6 years otherwise. This has direct impact on time value of money, which can be easily calculated with an appropriate discount rate.

All in all, with basic multiplication of above-mentioned average figures, expected gain (EG) of an entrepreneur is more than 50x higher if he/she partners with a venture studio compared to creating company traditionally.

Venture studios stack the odds greatly in entrepreneurs’ favour. With the availability of such modern company building practice and increasing number of venture studios around the world, it should be expected that more and more people will choose the entrepreneurship path in the following years.