Demystifying venture studio models

When I decided to become an entrepreneur and establish my own venture studio, I began serious research on the subject. What surprised me was the nomenclature for venture studio and the related models being still unclear among global community including studio founders, entrepreneurs and investors. After all, venture studio model is out there since 1996 when Bill Gross founded Idealab in California.

After 15 years of professional career mixed in strategy consulting and financial services and having founded a venture studio myself, I believe I am a good match for conceptualising venture studio models. So, I wanted to provide a point of view to venture studio community about structuring different practices to build and scale multiple ventures under an institutional entity.

Enhance Ventures, a successful venture studio located in Saudi Arabia and serving the region, has the database of venture studios around the world (kudos for the great work). Last time we checked, there were more than 700 studios. Analysing this list in addition to other sources helped us identify similarities and differences between each studio and make informed strategic choices for our own venture studio – Compound.

First of all, let’s start with the essentials of a venture studio. There are three conditions:

- Studio must be a builder and take its portfolio companies from 0 to 1

- Studio must get sweat equity from its portfolio companies

- Studio must invest capital to its portfolio companies

These essentials in fact make the studio an institutional co-founder, who invests in own business. If all essentials are not met, the institution is not a venture studio. As mentioned earlier, in terms of nomenclature there is divergence within the community. The terms venture builder and start-up studio are usually used interchangeably with venture studio. However, based on which of these conditions above are met, a clearer terminology can be used. Here is how:

- If only the first condition (being a builder) is met, then the institution is venture builder. Bundl and Stryber are well-known examples. Venture builders are basically like consulting companies or agencies working with fees.

- If the first and second conditions (being a builder and getting sweat equity) are met, then the institution is start-up studio. Venture building arms of global consulting companies fall here since they get some equity in addition to large consulting fees. But they only help established companies build new businesses. There are also many agency-like organisations that provide service-for-equity to start-ups.

Using the same conditions, an alternative way to create distinction between venture studios and accelerators can be used. Although accelerators help and mentor their portfolio companies, they are not builders. For them, only second and third conditions (getting sweat equity and investing) are met, though equity and investment ticket size are usually small.

Now let’s continue with differences among venture studios. There are of course many dimensions that vary from studio to studio. Based on strategic choices on these dimensions, studios can operate very differently from each other. However not all dimensions are equally influential in strategic design of the studio. Therefore, it is better to split these dimensions into two.

The primary dimensions define the business model of the venture studio. There are five primary dimensions.

- Idea generation: some studios manage their own idea pipeline. Others expect entrepreneurs to pitch them ideas like VCs. Of course, there are hybrid cases too.

- Starting point: some studios conduct idea validation and begin company building activities by the central studio team without waiting for an ideal entrepreneur with CXO profile to co-found together. In this case, in order to make the company VC investable and delegate responsibilities, late-co-founder(s) or incentivised CXOs are integrated to teams during 1 to n stage. On the other hand, some studios conduct each end-to-end validation process with a founder-in-residence (FIR). In this case, FIR can also be named as early-co-founder. Again, there are hybrid cases too.

- Heavy support duration: in order to take the company from 0 to 1, typically at least 4-6 months of heavy support duration is needed. All portfolio companies eventually spin-out from the studio. Spin-out can be as late as series A, which is on average 2 years from company establishment for a start-up created by a venture studio.

- Ecosystem expansion: due to availability of investment capital, know-how and team, through vertical-like integration some studios expand their scopes and create side businesses of operational VC and/or traditional accelerator under one umbrella.

- External services: in addition to building own ventures, some studios provide services to 3rd parties (corporate or start-up) similar to venture builders or start-up studios as previously mentioned. These services include fees and sometimes equity. Yes, there may be some grey areas between these concepts.

The secondary dimensions are mostly driven by the choices made in primary dimensions and more related to how the studio operates. There are at least five dimensions to consider.

- Investment method: some studios invest directly to their portfolio companies, others use investment vehicles such as side-car studio funds. There are also those few who form SPVs to invest in one or multiple portfolio companies.

- Equity taken: according to GSSN (Global Startup Studio Network), equity that venture studios gets at establishment of portfolio companies ranges between 15-80% with 33% being the average. Equity taken is generally in parallel with control level of studio over portfolio company. However, this can change with different privileges over voting rights.

- Investment ticket size: this varies greatly from studio to studio. Some studios only participate in pre-seed round. Others have gunpowder and continue their pro-rata investments in seed and Series A. According to GSSN, the average investment of studio to a portfolio company is USD 232k. This amount can go up to (in some cases above) USD 2M depending on studio and portfolio company.

- Annual throughput: this typically ranges between 1-20 ventures per year. Less than 1 venture per year is more like serial entrepreneurship and this is not in line with parallel entrepreneurship approach of venture studios.

- Central studio team: regardless of the strategic choices, all venture studios need to form larger than compact teams. Some studios form dedicated teams to build and serve ventures. Others have pooled resources. During 1 to n stage, usually venture studios invoice their services to portfolio companies with small or no margins on top of their costs just like salary for an individual co-founder.

Although there are many possible combinations of above-mentioned dimensions, there are 6 frequently observed venture studios model archetypes with feasible combination.

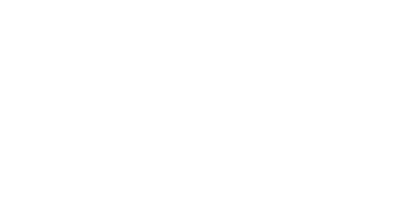

- Pure starter venture studio: starter venture studios typically manage their own idea pipeline and build new portfolio companies using central teams with or without onboarding early co-founders. They provide the longest heavy support to their portfolio companies. This model enables real parallel entrepreneurship under an institution for studio founders and partners. It is the most studio founder / partner driven model. For some community members, this model is the first one to come to mind.

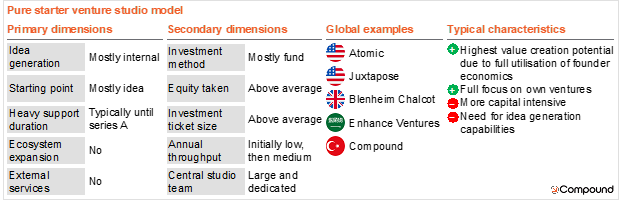

- Starter venture studio with ecosystem play: this model includes most components of pure starter model plus it has an integrated VC fund and/or accelerator that works with external start-ups. For some venture studios, this is the selected model to decrease hands-on venture building effort from studio partners while delivering higher returns to studio investors compared to traditional venture investments.

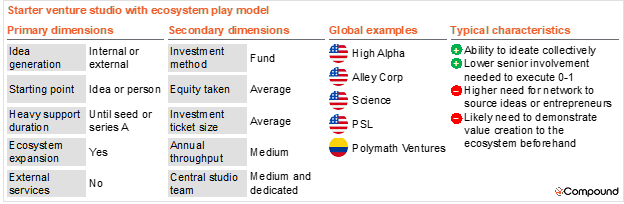

- Starter venture studio with agency services: while this model includes most components of pure starter model, at the same time it enables the studio to generate diversified cashflow earlier. For some studios, this is the selected model to focus less on fundraising for studio.

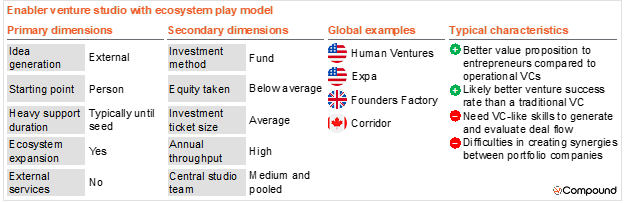

- Enabler venture studio with ecosystem play: enabler venture studios resemble to VCs in the way that entrepreneurs first need to pitch their ideas to them. So, they do not generate their own ideas but of course like all studios, they have an investment thesis making them focus on select domains. These venture studios need to be an active player in start-up ecosystem to generate quality flow of ideas and entrepreneurs. Therefore, some enabler venture studios have integrated VC fund and/or accelerator that works with external start-ups.

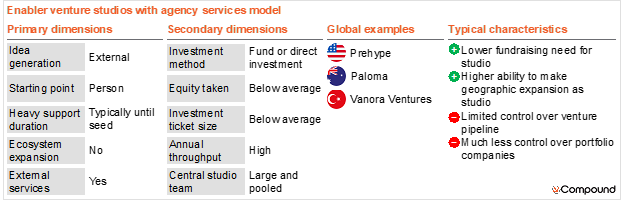

- Enabler studio with agency services: another enabler venture studio model is the one that provides venture building services to 3rd parties. This is sometimes the approach of venture builders or start-up studios to become a venture studio.

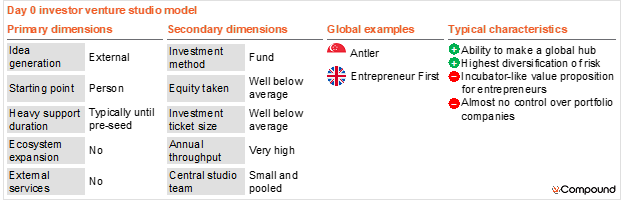

- Day 0 investor venture studio: although it is debatable if this model is a venture studio, reference companies slightly meet all three venture studio criteria (take 0 to 1, sweat equity and investing). This model is about hand-holding with entrepreneurs at beginning of the journey and can also be considered as a glorified incubator.

Besides these model archetypes, each studio has its own investment thesis that should not be mixed with studio design dimensions. Investment thesis of a studio is usually driven by the market that portfolio companies will primarily operate, backgrounds of studio founders / partners and preferences of key studio investors.

We believe each stakeholder in venture studio community – namely present / future studio founders, entrepreneurs, investors and studio staff – need better understanding of the landscape to make more informed apples-to-apples comparisons and take correct decisions regarding their venture studio journey. We hope this point of view will help each stakeholder in their own endeavours.